Self-Employment & Income Taxes

How Self-Employment Affects Your Income Taxes

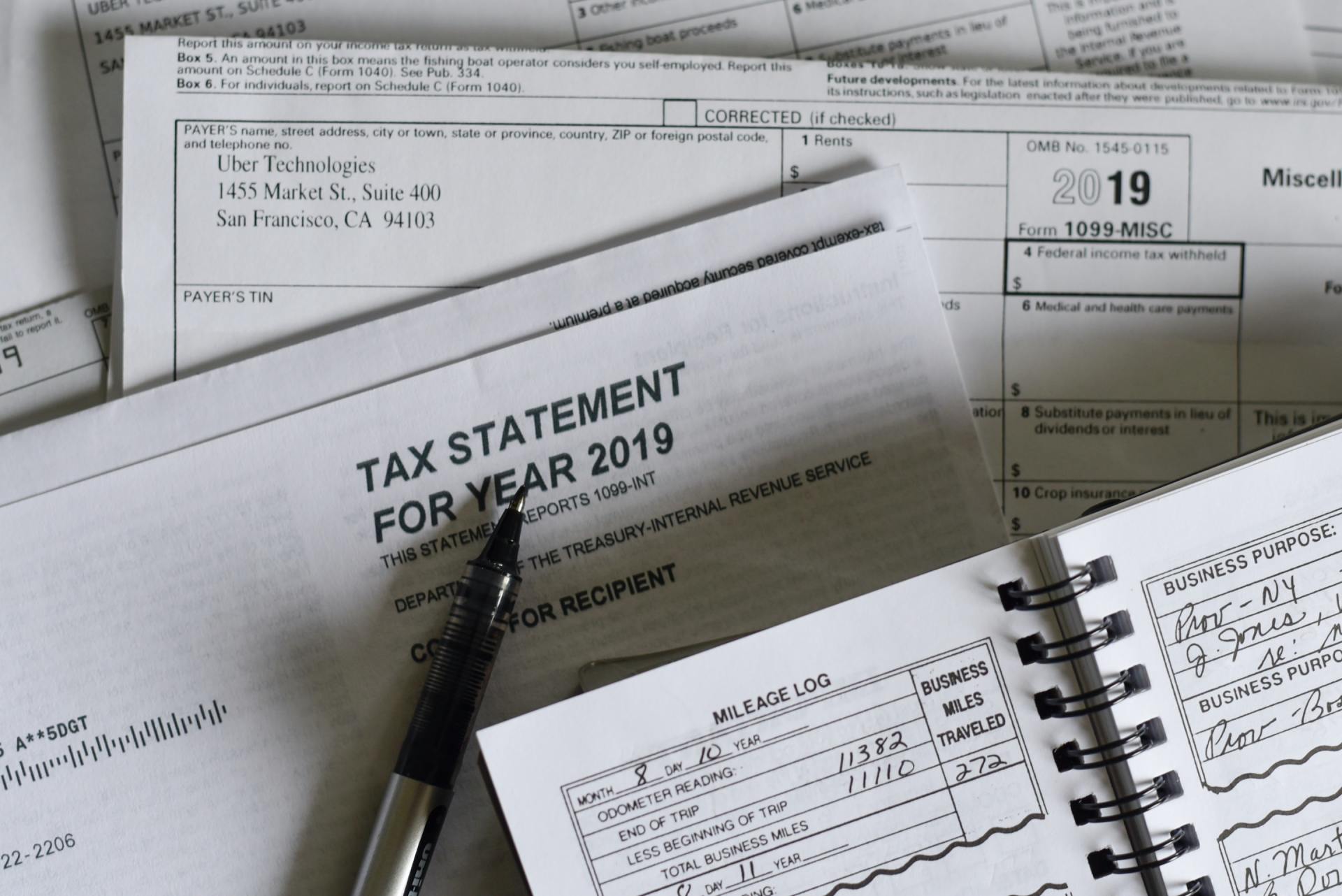

The gig economy is in full swing. There are many avenues for self-employment for people across the country. You can have your own small business where you sell products you create through an online shop, you can work on behalf of DoorDash, Instacart, Uber, GrubHub, and much more. When you enter the world of 1099 tax forms and work as an independent contractor, your tax deduction possibilities open up.

You can claim business expenses to reduce your personal taxable income. Common deductions include business miles, advertising, car payment interest, mortgage payments, meal expenses, and office equipment. This can potentially allow you to pay little to no income tax. The amount of each expense you can claim depends on a variety of factors such as the state you live in, how often you use personal assets for your business, and the everchanging federal tax code. Knowing exactly what you can and cannot write off as expenses, our tax consultant can help you maximize your deductions and minimize the amount of income tax you owe the government.

Contact Our Tax Consultant Today!

Rudolph M O’Neal III, CPA LLC is a tax consultant serving Anderson, SC. Income taxes are complicated, especially when you become self-employed. It takes a professional tax accountant to understand state and federal tax codes. They are always changing every year and what you can claim as a business expense does too. You need an accountant who can help you go over your expenses and claim all deductions that you can, saving you a lot of your hard-earned money. Contact us today for help minimizing your income taxes!