2021 Tax Season: How to Prepare & What to Expect from Income Tax Returns

Navigating 2021 Income Taxes

How to Prepare for Your Income Taxes

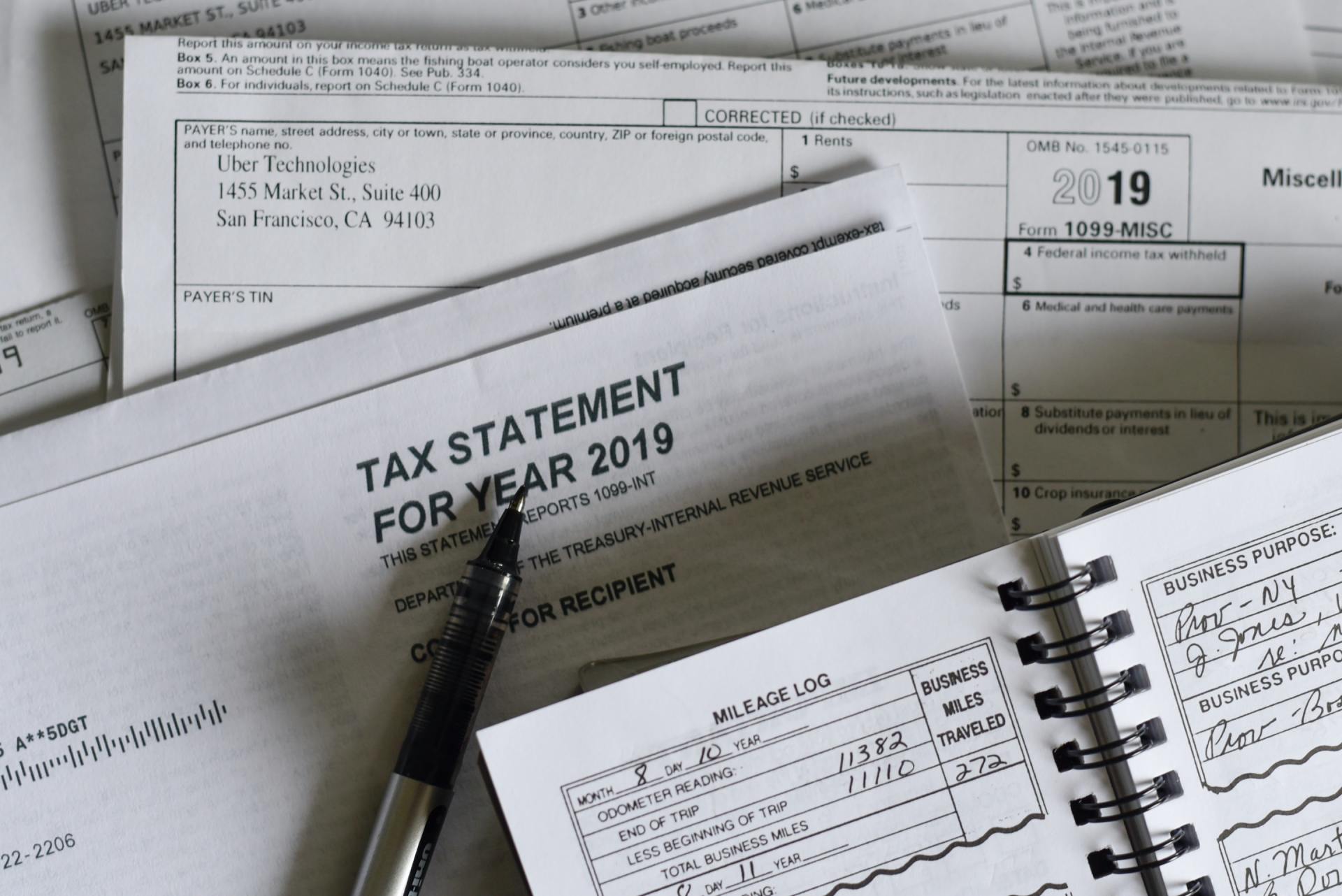

The first step is to gather all of your necessary documentation as this is the most complicated part. Once you have these documents, the rest is filling in information through your tax preparer's software. Some of the information you'll need includes:

- Copies of your 2019 returns

- Social Security numbers (for you, your spouse, and children)

- W2s

- 1099 forms

- Documentation of any alimony received

- Business income and expenses (for self-employed filers)

- Rental income (if you own investment property)

- Mortgage interest and property taxes paid

- Educational expenses

- Student loan interest paid

- Charity contributions

- Reports indicating health insurance coverage

- Retirement account information

- Childcare expenses paid

What to Expect

For 2020 tax returns, the tax rates, or the percentage of your income that you pay taxes on, have remained the same. However, there have been some slight changes to the tax bracket, or income range, that you fall into. The brackets have been adjusted slightly, a few hundred dollars, from last year to account for inflation. The standard deduction has also increased slightly due to inflation. Your tax preparer will help you figure out where you fall and what options are best for you.

Tax deductions will help lower your income that can be taxed by the federal government. Some of these deductions include charitable donations, medical deductions, and business deductions. Tax credits lower your actual tax bill dollar for dollar including the Earned Income Tax Credit and the Child Tax Credit.

As far as stimulus checks, some people are wondering if the payment is taxable, The IRS says: “No, the payment is not income and taxpayers will not owe tax on it. The payment will not reduce a taxpayer's refund or increase the amount they owe when they file their 2020 or 2021 tax return next year. A payment also will not affect income for purposes of determining eligibility for federal government assistance or benefit programs."

Those who were unemployed last year, largely due to the coronavirus, and received unemployment benefits, will be required to pay income taxes on that money. Some may have chosen to get taxes taken out of these payments, while others may have opted for more money upfront.

Contact Our Tax Preparation Service

If you find that income taxes are confusing and complicated, you're not wrong. Working with a tax preparation service is always a smart move, especially with the changes in the tax industry and the new changes due to the coronavirus. If you are looking for a trustworthy tax team in the Anderson, SC area, rely on the team at Rudolph M O'Neal III, CPA LLC. Contact us today to set up an appointment.